Forming a Delaware LLC may be one of the smartest moves a business owner can make. First of all, Delaware is one of the three most LLC-friendly states in the nation (along with Nevada and Wyoming). Secondly, the entire process is quick, easy, and comes with a variety of legal benefits. Third, by Delaware law, you don’t actually have to live in the state to form an LLC in Delaware. Finally, this flexible business entity has low start-up costs.

Ready to get started but don’t know where to begin? Complete the consultation form located here or utilize one of the phone numbers on this page. Meanwhile, here’s just about everything you need to know about Delaware LLCs.

What is an LLC?

According to Investopedia, a limited liability company, more commonly known as an LLC, is a corporate structure that provides liability protection and flow-through taxation for owners. In other words, an LLC treats owners (generally called members) like partners. By default the IRS treats it as a sole proprietorship for tax purposes if it has one member; as a partnership if it has two or more. In addition, the IRS also provides an opportunity for the company to be taxed like a corporation, either C or S. So, unlike a corporation it has tremendous tax flexibility. That is, you can choose to have the LLC taxed in one of four ways.

One must file properly drafted articles of organization with the state. However, the owners can spell out all tax, management, and organizational preferences in a private operating agreement. Thus, this structure gives them the flexibility to handle their business as they see fit. At the same time, the LLC can protect their personal assets in case someone sues the company.

How a Delaware LLC Works

The articles of organization, or Certificate of Formation, cover all of the basics of a Delaware LLC, including:

- Names of owners/members and managers

- Name and address of the registered agent

- Name and address of the company

- Business plan, purpose, and structure of the company

Similarly, an operating agreement can lay out additional organizational and management preferences. It is not required by the state. However, not having one can severely limit the lawsuit protection benefits. So, be sure you have a professionally drafted operating agreement.

Interesting features of a Delaware LLC:

- LLC members share in the profits/losses of the company is listed in the LLC’s operating agreement.

- Managing a Delaware LLC falls to the members themselves, a hired manager, or a management committee. Members also have the ability to act as passive investors.

- Delaware LLC taxes are based on the company’s profits and losses. As a flow-through entity by default, an LLC passes the company’s profits/losses to its members. Therefore, profits are listed on the personal tax returns of members as personal, not company, income.

- LLC voting rights in Delaware are frequently, but not required to be, based on the members’ capital investment amounts. If the operating agreement doesn’t cover voting rights, the LLC must defer to Delaware’s voting rules.

- Delaware LLC transfer rules allow a member to sell or give interest in the company to another person. This is as long as all members have voted and reached a majority approval prior to the transaction. If the operating agreement doesn’t cover transfer rules, Delaware provides fallback rules.

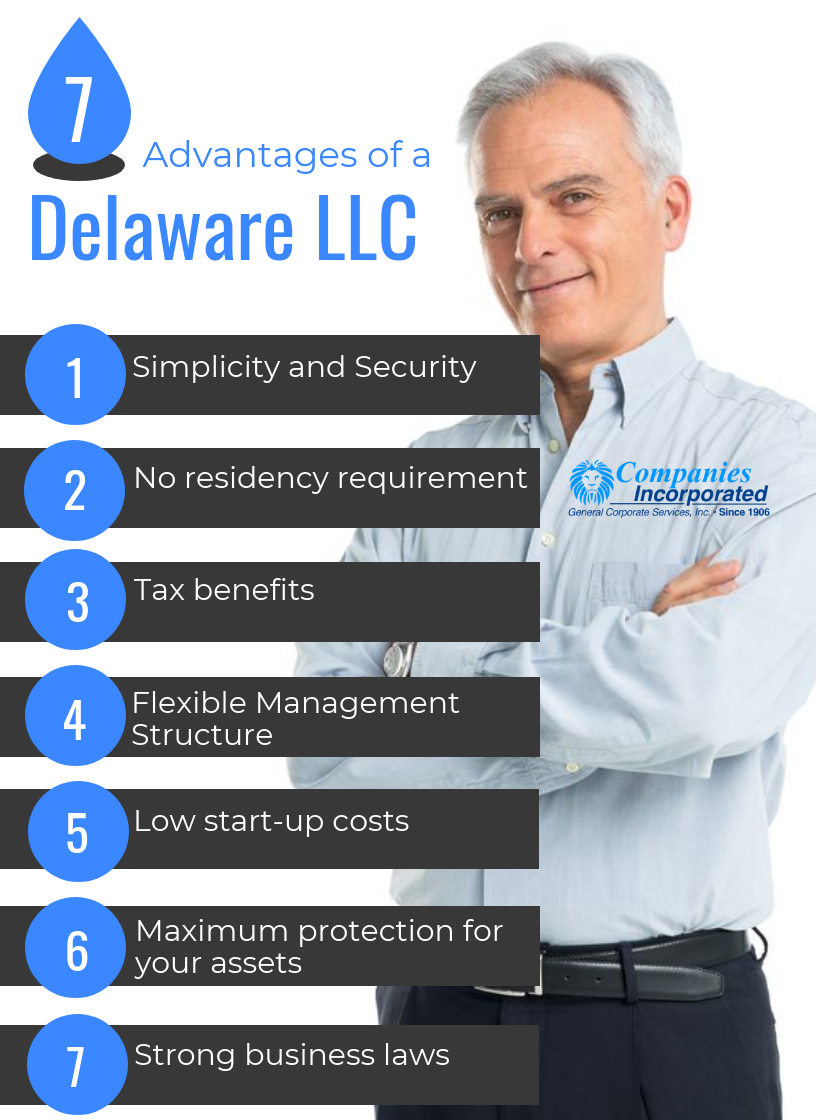

Delaware LLC Benefits

Whether you’re starting a small business or pooling investment assets, you may have heard that forming a Delaware LLC is a popular choice. So, what’s all the fuss about? Delaware LLCs come with a lot of perks! Just take a look at these seven benefits of forming a Delaware LLC

1. Simplicity and Security

Unlike many states, Delaware doesn’t require you to include the names and addresses of members or managers on an LLC’s formation documents. This protects your identity and personal information from becoming public record. Instead, you just need to designate a contact person and a Delaware registered agent to form or maintain your LLC. Also, Delaware LLCs require very little maintenance with no voting or meeting requirements outside of the operating agreement established by LLC members.

2. No residency requirement

Since the state of Delaware permits out-of-state investors, you don’t actually have to live or do business in Delaware to form a Delaware LLC. You do not even need to live in the United States. The state only requires that you maintain a registered agent in Delaware to handle all official correspondence from the Division of Corporations. Also, you don’t need to obtain a Delaware business license, register with the Department of Revenue, or pay Delaware’s gross receipts tax.

3. Tax benefits

Delaware is the most business-friendly state when it comes to taxes. For example, Delaware LLCs that operate outside of the state don’t pay sales tax, income tax, or intangible income tax (for things like patents and trademarks). Also, LLC members can choose how the company’s income will be taxed. Options include:

- Disregarded: A single-member LLC that pays income and self-employment taxes on net business income. Taxes and deductions flow through to the member’s personal tax returns.

- Partnership: Each member of this multi-member LLC pays income and self-employment taxes on their share of the income. Taxes and deductions flow through to the member’s personal tax returns.

- S Corporation: Single- or multi-member LLC that files taxes yearly. The profits and distributions flow through to the shareholder’s personal income tax forms.

- C Corporation: The LLC pays corporate tax rates its retained earnings and members pay income tax on payments from the corporation.

4. Flexible Management Structure

One of the greatest LLC benefits is freedom of contract. The LLC operating agreement (a document created by LLC members) lays out the structure of the company. Therefore, all terms and rules can be tailored to meet the member’s needs. Delaware LLC members can manage the company themselves or designate managers to do it for them. Also, a single person or investor can form a Delaware LLC. In other words, you can be the President, Vice President, Secretary, and Treasurer all rolled into one.

5. Low start-up costs

The inexpensive cost of forming and maintaining a Delaware LLC makes it a popular choice for many people. According to the Delaware Division of Corporations’ fee schedule, forming a Delaware LLC is much lower than many other states. Annual fees include a franchise tax fee that varies year to year and a registered agent fee. With such low costs and no capital requirements, forming a Delaware LLC fits almost any budget.

6. Maximum protection for your assets

Delaware LLCs provide a variety of liability protections for business owners. For one thing, suppose someone wins a judgment against your company. In that case, liabilities are only enforced on company – not personal – property. Conversely, if a member of the LLC has debts or a judgment filed against them, the creditors cannot go after the LLC’s assets.

Also, members and managers of a Delaware LLC can remain anonymous. Thus, this makes it easier to shield assets from potential creditors. Simply put, a local Delaware LLC registered agent can remove all reference to investors so that only the IRS knows about your assets and income.

Charging Order Protection

In fact, about the only way for creditors to pursue a member’s ownership interest in a Delaware LLC is by acquiring a charging order. According to Investopedia, a charging order allows a creditor to place a lien on a member’s interest in the LLC. The creditor could, in theory, seize money paid to the named member, partner, or “owner” of an LLC.

Keep in mind, this does not give the creditor rights of ownership to the company. It only means that the creditor can attach distributions to the debtor until the debt is paid. Fortunately, Delaware offers charging order protection for LLCs. Unlike other states, charging orders in Delaware only entitle creditors to an individual member’s financial interest. The creditor cannot use it to foreclose on an LLC owner’s interest or force the LLC to dissolve and sell its assets.

Now, here is the good part. In most states you need two or more members or you lose the charging order protection. In Delaware, you only need one member in order to enjoy the protection that the charging order gives you. Wyoming and Nevada are the only two other states, as of this writing, to have one-person charging order protection.

A Creditor Booby Trap

It gets even better; much better. Your LLC does not need to make distributions to you through the duration of the charging order. Therefore, the money accumulates in your LLC and your creditor receives nothing. Moreover, Revenue Ruling 77-137 says that whoever has the rights to the distributions must pay taxes on them whether he/she receives them or not. So, your creditor gets stuck with your tax bill, but receives no money. You read that right. Your creditor must pay taxes on your portion of the profits whether the creditor receives the distribution or not. After the first tax bill, with no money to show for it, most creditors will go down to the courthouse and remove the charging order.

7. Strong business laws

Another benefit of forming your LLC in Delaware is the state’s long history for establishing business-friendly case laws. Often referred to as the nation’s leader in business law, Delaware provides a wide range of statutes that many states use as models when drafting their own corporate laws. Delaware has a specific court, the Court of Chancery, for dealing with business disputes. Known for its corporate law expertise, the Court of Chancery decides all cases by judges, not juries, who specialize in this area and utilize over two hundred years of case law in making their rulings.

The Court of Chancery decides more than 1,000 civil lawsuits every year, so most legal disputes have likely already been argued in court. This gives business owners an idea of whether to settle or fight a lawsuit ahead of time, which may save you a lot of time and money spent on legal fees.

How to Form a Delaware LLC

So, you’ve decided to go ahead with forming an LLC in Delaware. But where to begin? Fortunately, forming a Delaware LLC is simple. The filing process usually takes about 4-6 weeks, but an expedited option is available (for an extra fee) that takes as little as 1 business day, plus 3-5 days for mailing.

Get started on your Delaware LLC formation by following these 5 steps.

1. Choose a name

Every company needs a name, and your Delaware LLC is no different. Make sure your company name complies with Delaware naming requirements. For example, your name:

- Must include “limited liability company” or one of its abbreviations

- Requires an accompanying translation if it includes words in a foreign language

- May require additional paperwork and a licensed individual if using restricted words (e.g. Attorney, Bank)

- Must not include words that may be confused with a government agency (e.g. FBI, State Department)

- Must not include words deemed lewd, racist, or objectionable by the Delaware Secretary of State

Check the availability of your chosen company name. If you want us to form your Delaware LLC, call our offices and see what name is available. You can also search if your business is available as a web domain.

2. Nominate a registered LLC agent in Delaware

According to Delaware state law, any company formed in the state must have a registered agent. Your business’ main point of contact with the state, registered agents receive legal documents on your behalf. Registered agents must have a local business address in Delaware to qualify as your Delaware LLC registered agent. We provide registered agent services in all 50 states.

3. We file the Certificate of Formation

Filing a Certificate of Formation with the Delaware Division of Corporations is akin to filing a birth certificate for your Delaware LLC. As previously stated, the Certificate of Formation lists important information about your company, such as the name and address of your Delaware LLC and the address of your registered agent. Fill out an inquiry form on this page or utilize one of the phone numbers above and we would be glad to help you.

4. We create an operating agreement

Though not required by the state of Delaware, an operating agreement outlines the ownership and operating procedures of your Delaware LLC. As a legal document, the operating agreement:

- Structures financial and working relationships with your co-owners

- Helps guard your limited liability status

- Protects against misunderstandings

- Ensures that your company is governed by your rules, not those created by the state

When we form an LLC we automatically provide an operating agreement.

5. Establish an Employer Identification Number (EIN)

Essentially a social security number for your company, an EIN is a form of Taxpayer Identification Number that helps the IRS identify your business for tax and filing purposes. It also allows you to open an LLC business bank account, apply for licenses and permits, file taxes, and handle employee payroll. The good news: we can apply for an EIN for you. Just ask a representative.

Let’s Get Started!

Even though establishing an LLC in Delaware sounds quick and easy, you should cover all of your bases by consulting with our Delaware LLC experts before taking the plunge. Our team will walk you through the entire process to ensure that you have a full understanding of the guidelines and responsibilities. We’re happy to answer your questions and concerns, so contact our team today.