A land trust is a documented agreement to which a property holder transfers the title of a property to a trustee. The trustee must follow the terms of the trust and act in the best interest of the beneficiary. The settlor is the one who initiated the trust. The beneficiary, in turn, is the one who benefits from the trust. The settlor and the beneficiary are usually one and the same. That is, the same person usually holds both positions. Furthermore, it is usually the person who owned the property before he or she placed the property into the trust.

With most land trusts, the beneficiary gives property management directions to the trustee. As such, a land trust is a contract between the trustee and the beneficiary/settlor. The beneficiary continues to receive the rights to the property. This includes, but is not limited to, the right to occupy, rent, develop or sell the property.

Land Trust Benefits

Purchasing real estate as your home or for you business can be a costly venture. Public records, media, personal vulnerability, and litigation issues make you all the more exposed. As you know, that risk simply comes along with buying a piece of property. Just to be clear, when you use a land trust, buying land outright isn’t your only option. You can also use it to buy developed property.

Using a land trust for property is attractive because it keeps the property owner anonymous and provides extra legal protection. Buying land outright can bring unwanted attention to a business and cause the price of future property purchases to skyrocket. Most land trusts are created as revocable trusts, which allow the trust grantors to amend the terms or terminate the trusts at any time. They do not typically provide asset protection on their own. However, properly structured irrevocable land trusts can provide extra asset protection.

So, a land trust is a way to buy property discreetly, and often for much less money. Creating a land trust adds anonymity to purchases so that your business can grow and expand with more freedom. But how does a land trust work? We’ll explore that in-depth throughout this article.

Types of Land Trusts

There are many different types of land trusts, but Legal Dictionary defines the three most popular.

The first type of land trust is a conservation land trust. This trust has the goal of protecting sensitive natural areas, farm or ranch lands, landmarks, water sources, and more. Often, these trusts focus on land that is near an already protected area, as they can still be home to endangered wild and plant life.

The second type of land trust is a community land trust. This trust is usually used by non-profit organizations to ensure the availability of affordable housing for low income residents in a community. Where a homeowner typically must pay for the building structure and the land it sits on, a community land trust allows them to only pay for the structure. It helps to encourage people to purchase homes who might not have been able to do so otherwise.

The third and most common type of land trust is a corporate land trust, or a real estate land trust. This type of land trust allows individuals or corporations to acquire developed real estate or tracts of land without alerting the public to their acquisitions. Keeping the new properties in trusts maintains anonymity. In addition, it can help prevent huge price hikes and publicity if a well-known wealthy buyer pursues the property. One of the biggest historical examples of this type of trust is when Disney bought small portions of real estate in Orlando, Florida with land trusts. Those pieces of property would eventually become Walt Disney World, and would have been significantly more expensive if the company had acquired all the land without using trusts.

For the purposes of the rest of this article, we will focus on real estate land trusts and their benefits.

Illinois Land Trust

But wait – what about the Illinois land trust? You may have heard this term used as a popular type of land trust. Despite its name, it isn’t just available in Illinois.

As Exeter explains, using a land trust for property isn’t new. Some variation of the land trust dates back to Roman times, although its clearest history starts in the 16th century. In the late 19th century, however, property owners in Chicago, Illinois figured out that land trusts would be a great vehicle for buying, holding, and developing real estate. This gave real estate investors a way to privately and confidentially acquire properties. Hiding their land ownership was very important at the time, since they were forbidden to vote on city building projects when they owned land nearby.

Legal issues about the validity of using land trusts were brought up in response to this, because it was a passive acquisition. The issue went to the Illinois Supreme Court. There, it was ruled that if the land trust was set up with some minor duty on the trustee, the trust is considered active and valid. This ruling had a great impact on the future development of land trusts and helped shape how they work today.

The “Illinois land trust” is now just another term for that encompasses many of the corporate land trusts discussed in the last section.

Pros and Cons of Land Trusts

To find out more about creating a trust for property, let’s look at some of the pros and cons. How Stuff Works gives an in-depth look at this.

The main benefit to the real estate or corporate land trust is privacy. After the title of a property is transferred into a trust, the names of the owners cannot be disclosed without a court order. This helps to avoid litigation. If there are multiple owners, the land trust protects the other owners if legal charges are brought up with only one owner.

Another large benefit of a land trust is the ease of transferring ownership of the property to beneficiaries or heirs. Without a trust, an individual’s will has to be assessed through a costly legal process called probate, which involves paying back taxes and debt. Land trusts, unlike people, don’t die – so the succession plan set up in the trust remains in place without needing probate.

A disadvantage of using a land trust is the false belief that it protects the land owners from all liability. In cases dealing directly with the management of the property, the property owner, not the trustee, is liable. Trusts aren’t tax-exempt either. The tax responsibility flows through to the settlor. As mentioned above, the settlor os the one who initiated he trust.

Land Trust vs Living Trust

Another common trust people use to own real estate is the living trust, so what’s the difference between that and a land trust?

As Home Guides explains, the main difference is in the kinds of things the trust owns. A living trust, often called a family trust, is used to hold assets for yourself and your family. When you die, your named secondary beneficiaries step in to become the primary beneficiaries. The trustee, usually also the settlor hold assets like your home. Primary beneficiaries usually include you and your spouse. Your children are usually the secondary beneficiaries. Family land trust agreements keep property out of probate and can reduce a family’s estate tax liability.

Land trusts, on the other hand, are most often used by real estate investors. They are often revocable and provide added privacy for the property owners. They can also set up a line of succession and avoid probate like a living trust, though.

In simple terms, people use land trust for real estate ownership anonymity. On the other hand, people use living trusts to handle estate planning for personal assets.

Setting Up a Land Trust

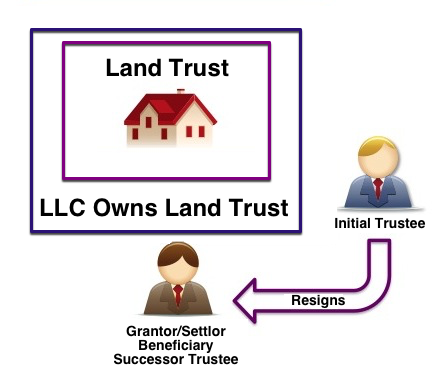

In preparing to set up a land trust, there are a few things to keep in mind. First, as Anderson Advisors, explains, there are three main parties involved: the grantor/settlor, the trustee, and the beneficiary. The grantor is the creator of the trust and has the responsibility of transferring assets into the trust. The trustee manages the trust and holds the title to the property. They manage the duties as assigned by the beneficiary. The beneficiary is often the same person as the grantor, but if you want better protection, the beneficiary could be your LLC. The beneficiary possesses the actual ownership of the property and receives all the benefits of the assets involved in the trust. Moreover, the beneficiary also has the power to fire the trustee and appoint a successor.

In terms of paperwork, we draft a land trust agreement and a property deed. These should be filled out with the help of legal professionals, such as ourselves, who can ensure proper wording and authority on these documents. You will need a unique name for your land trust, such as the address of the property inside the trust. An example is, “123 Main Street Trust.”

Choosing a Trustee

Be sure to choose a trustee you can get along with. The trustee will have a lot of fiduciary and managerial responsibility over the assets in your land trust. Some characteristics to look for in potential trustees are financial integrity, knowledge, trustworthiness, honesty, and shared values with you or your business. You can have the trustee sign a resignation letter after you record the property title documents and take on the trustee role privately. Better yet, we often set up your own Wyoming LLC to act as trustee. You will have a nominee manager’s name show up in the public records. You will also have a virtual office address in Wyoming. This way, you act as the “man behind the curtain” pulling all of the strings.

Here is the problem when using a friend or family member as trustee. Most potential trustees worry about legal responsibility. There is really little, if any, liability the trustee bears unless he or she does something intentionally dishonest. In truth, the settlor/beneficiary is the one calling the shots. The beneficiary bears the liability. So, it is better to use your own Wyoming LLC as trustee than using squeamish worry-wort. Your own LLC will cooperate fully and not squirm and fuss and fear monger like most uniformed trustees do.

Asset Protection and Liability

There is one more very important thing on the liability issue. For investment property, we will typically place an LLC in as the beneficiary of a land trust. We do this for two reasons. First, when there is a lawsuit tied to the property, the LLC acts to protect the beneficiary or beneficiaries from liability. Second, when someone sues a member of an LLC, there are provisions in the law that can protect that member from losing his interest in the LLC or assets inside. This includes the land trust and the property, itself. Most states require two or more members for the asset protection features to kick in. Wyoming, Nevada and Delaware require only one member.

We don’t usually use an LLC when a land trust owns a primary residence. This is because the personal residence and rental properties are in different tax categories. In order to enjoy the benefit writing off the legally allowed interest on personal tax returns and capital gains exemption, the occupant/”homeowner” remains as the land trust beneficiary.

Protect Your Real Estate

If you want to ensure that you get all the benefits of setting up a land trust for your next real estate purchase, contact our experienced consultants. Protecting your purchase with a land trust can be complex to set up without help. Make sure to get professional help so you can get all of the benefits without leaving yourself open to litigation. We’ll help you explore your options to determine the right course of action for you and your property.