A virtual office is a service that provides a mailing address and telephone receptionist services. The company that utilizes the service does not physically occupy the office. Typically several companies utilize the virtual office address. As a result, this service offers a significant savings over a traditional office space and receptionist costs. In addition, many people use this setup for financial privacy. That is, so the assets held in a corporation or LLC are not tied to the address of the owner, officer or director.

The Virtual Office Program is available in all 50 US states and many foreign countries.

Nominee Officers and Directors

Nominee privacy service is where one of our associates appear in the public records as your officers and directors of your corporation or manager of your LLC. You main control by holding all of the voting rights, by owning the company. Notably, you have the documentation in your possession showing the company is yours. Though, then someone looks up your company or your name in the public records, they see no association between you and your company. Therefore, you can have a big bank account or brokerage in your company name. Prying eyes will not easily find it.

In addition, it can own real estate for you anonymously. Thus, what does a hungry contingent fee attorney see when searching for your assets? Little to nothing. Do you have enough money and other assets exposed to make suing you worthwhile? Likely not, if you own your assets in the proper legal tools.

Virtual Office Benefits

There are many benefits inherent when you incorporate or form an LLC. This is especially the case when you form a Nevada or Wyoming LLC with a bank account. This is because the asset protection laws in these two jurisdictions outshine most other states. There are even greater asset protection benefits in offshore jurisdictions, such as that of a Nevis LLC. Above all, take advantage of laws that protect shareholders, officers and directors. Nevada and Wyoming are the strongest in the US. Plus, there are no corporate state income taxes in either of these states. Nevis is the strongest worldwide. Likewise, there are no income taxes in this popular locale. Now, US people are taxed on worldwide income, so that means there are no additional income tax forms to file in that jurisdiction.

Most people use Nevada, Wyoming or offshore companies for these primary reasons:

· Either to to operate a business in their state of residence, or,

· To protect personal assets and to increase privacy and confidentiality

Both of these reasons can prove extremely beneficial to your business. But there are steps you can take to ensure that you see the benefits you expect. Plus, you can even enhance these benefits by adding nominee services to enhance your privacy as we have discussed above.

Nevada or Wyoming Corporation in Your Home State

A Corporation formed in any one of the 50 states can conduct business in all states. For example, let’s say you live in California and own a trucking company. You want to minimize your tax liability and provide further protection for your assets. So, you form a Nevada Corporation for your trucking company, then register in California as a foreign corporation. This is known as “foreign qualification.” The state of California taxes any income derived from that state.

However, your corporation could still enjoy tax-free status in Nevada on any income derived in that state. The same goes for any other state where it operated that had similar state tax-free laws, or no “foreign qualification” requirements. In order for you to enjoy these tax benefits, however, it would have to be a “resident” business. The requirements we’ve outlined below will determine this.

Increase Privacy and Protect Assets

Nevada Corporations offer unparalleled privacy and excellent asset protection for directors, officers, and stockholders (owners). By statute, neither stockholders, nor officers/directors can be held liable for any debts or liabilities incurred by the Nevada corporation. Nor are stockholder names a matter of public record. Only Directors and Registered Agents are a matter of public record. One can even organize these positions privately. By utilizing nominee appointments, for example, one can to enhance the confidentiality and privacy of the “true” owners of the corporation. Using our trusted Nominee Service, you can be assured that your name will be kept confidential to casual prying eyes.

For example, you can pay some of your business and investment profits directly to your Nevada Corporation. This can increase privacy and protect assets. One can accomplish this by establishing a Corporation in your home state, then another Corporation in Nevada. The Nevada company, in turn, can be used to transact and receive income from your home-state Corporation. Thus, the business you operate in your home state can hire your corporation in Nevada. This can be such things as management, consulting, or for the sale of business supplies, etc.

Meets the Physical Presence Requirement

Because you will have properly established your corporation as a resident Corporation in Nevada (using our simple, efficient Nevada Office Program or Nevada Virtual Office Program), and arranged for nominee officer appointments via our Nominee Privacy Service, your Corporation would earn its money discreetly and with utter confidentiality. You would be able to pay yourself a salary from the Nevada Corporation. Because federal taxation of a C Corporation is much less than the individual rate in almost all tax brackets, you could realize further tax savings. (Again, if a corporation operates in a state with corporate income tax, it must follow the tax laws of the state in which it operates. This may not include the income tax-free benefits when operated only in Nevada. Check with a knowledgeable tax advisor).

A further example: If you have substantial stock market investments, you can form a Nevada Limited Liability Company (“LLC”) to hold these investments. You can then arrange for your Corporation in Nevada to manage these investments, and pay “for management services rendered” fees to your corporation in Nevada from these investments via the LLC. All the while your name will not be registering as earning all of this passive, and expensively taxed, income.

What is the Virtual Office Program?

In order to benefit from the maximum financial privacy, limited liability, and asset protections offered by your Nevada Corporation, it must meet certain “residency” requirements. You must be able to sufficiently prove that your corporation is a legitimate, operating business in Nevada.

To do so, it must pass these four simple tests:

- The company must have a Nevada business address, with receipts, or supporting documentation as proof.

- It needs a Nevada business telephone number. [1]

- Must have a Nevada business license

- The Corporation or LLC must have a Nevada Bank account of some sort (checking, brokerage account, etc.).

Virtual Office Affordability

As is evident by these requirements, a simple P.O. Box or answering service won’t suffice. In order to pass muster, there must be a living, breathing office supporting your Nevada Corporation. The downside of opening and then sustaining an office is that it can be quite expensive, especially if the Corporation in Nevada is an extension of your tax-reductions strategy and you are looking to maximize your investment in your corporation. When opening an office, you would have to factor rent, staff, utilities, telephone and data services, employment taxes, supplies, and insurance. Let’s put these into “monthly cost” perspective:

| Office Rent | $1500 |

| Staff | $3000 |

| Utilities | $200 |

| Telephone & Data | $100 |

| Maintenance | $100 |

| Supplies | $200 |

| Employment Taxes | $300 |

| Insurance | $200 |

|

|

|

| Total: | $6000 ($72,000/yr.) |

These costs added up quickly to the tune of $6,00 a month. In fact, these are relatively conservative cost estimates, with actual potential costs much higher. Multiply this figure by 12, and you can see that even a basic “base of operations” office can cost your corporation $72,000 a year.

But we have the sensible solution to meet your needs! We can accomplish all of this for your company starting at just $995 to $2,995 for the entire year, depending on the package you choose. With our Nevada or Wyoming Office Program (also known as the Nevada or Wyoming virtual office program), we can offer your corporation a proper office and business address (available by appointment), staffed by contracted people during regular business hours, a live person answering your (shared) business telephone number, personalized mail forwarding service, and assistance with the opening of bank or brokerage accounts. We offer similar service in many of our offshore locations.

What’s Included?

Included in our Companies Incorporated Nevada Corporation Office Program:

· An actual Nevada street address — staffed with contracted employees from 8am to 5pm

Pacific Time Monday through Friday.

· Mail forwarding service personalized to your needs

· A Nevada shared telephone number answered by a live receptionist

· A Nevada fax number

· Help opening a Nevada bank account if desired

· Help applying for a Nevada business license

· Live contract employees to greet your callers during business hours.

· Notary service

· Secretarial service

· Privacy

The Companies Incorporated Nevada Virtual Office Program will cost you only $110 per month if you pay on a month-to-month basis with a one-year minimum commitment, but again, you can take advantage of our $325 discount for yearly prepayment. You pay only $995 for an entire year of service.

Savings Over Conventional Office

These packages can save you thousands of dollars in operating expenses, while preserving all of your hard-earned, and achieved, tax reductions.

Our Nevada Corporate Office Program meets and satisfies all of the standards necessary for a resident Nevada corporation determination. Plus, these services are delivered in a knowledgeable, friendly professional manner. Experienced personnel that have been providing these types of services for over 30 years handle your affairs. So, we can offer this program at such an enticing price because of our high volume of business and efficient organization.

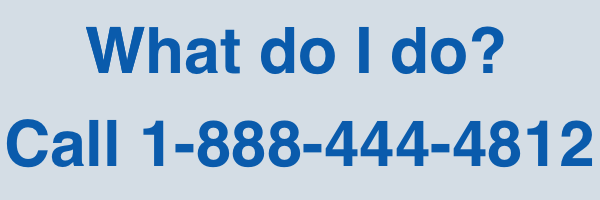

The number on this page or the form provided above can be used to obtain additional information of the wonderful TAX SAVINGS and PRIVACY options available with your Companies Incorporated Virtual Office Program.