What is a Shelf Corporation / Aged Corporation?

A “shelf corporation,” also known as an “aged corporation,” or “aged shelf company” when referring to an LLC, for example, is a corporation that is already formed, but not in use, and ready for “purchase” by a new owner. There are many reasons that people purchase shelf corporations. On the other hand, there are certain things to look out for when considering one of these “ready made” corporations.

Click to see our LIST OF AGED COMPANIES

Why Should I Use or Acquire a Shelf Corporation?

It is responsible to note that age is not the only factor. It is likely not a main factor in business and lending relationships, engaging in business, credit, or real estate agreements. As an established company it can save some time. That is, you don’t have to go through the entire process and waiting period to establish a brand new corporation. Most potential business resources are hesitant to engage brand new or up-start corporations. So, with an existing company, you can approach them as an established entity that has actually been in existence. Obviously, the more years the corporation has been in existence, the better. Therefore, it is more likely that your business contacts take your company more seriously. As such, this may grant your business more access to business relationships.

To be clear, the credibility increases, in our opinion, when you use the company to actually engage in business; not merely by the number of years someone set company on a shelf. These relationships may include agreements, Dun & Bradstreet-type rating systems, etc., may also all be considered when looking at potential aged corporations. Additionally, it is of paramount importance that you acquire these shelf corporations from trusted sources. For example, we go to great lengths to perform the intricacies of weeding out those with potential or existing liability.

Does an Aged Company Give You Credibility?

Once you have properly selected your shelf corporation, the company has immediate filing history. Does it give you instant credibility for your company and corporate image? We cannot say that that will necessarily happen. But, what if you choose a company that coincides with the number of years that you have actually been engaged in the type of business that the corporation will perform?

Naturally, there is no guarantee that you will instantly be able to bid on state contracts. By the way, states generally have minimum longevity rules for companies that they allow to bid on their contracts. We do not guarantee you will be able to obtain lines of credit easier. We don’t promise you will obtain loans from the Small Business Administration or banks in your state. Nor do we conclude that you can attract potential investors more readily with an “established” corporation. The bottom line is, be honest. Let others know that you recently obtained the company, if that is the case.

As we mentioned above, one thing is critically important. You want to insure that the shelf corporation you are considering not have any inherent or lingering liabilities. For the most part, you can assure yourself of this by looking into the history of the corporation. For example, you may want to verify that the extent of its business activities were that someone applied for an EIN. Maybe it opened a bank account.

Exceptions to the Rule

There are some quantifiable exceptions to this rule. There are times when very well established corporations get shelved, for a variety of reasons. These can be inherently quite valuable due to their tenure or amount of time in existence. Qualified entities can carefully scrub it for liabilities and exposure. Aged companies are in high demand. Moreover, the demand and price increases depending on how long they have been established.

Simply put, if you are buying an aged corporation directly from its owners, you should do some due diligence. You should be concerned if the person or group selling the aged corporation has engaged in any transactions; especially ones that may produce some type of future liability for the corporation or its stockholders. This may not always be easy to examine, and certainly requires some expert investigation. The best practices approach is to only acquire aged or shelf corporations from reputable providers (or resellers). The provider should have a history of successful transactions in this arena. You can count on these providers to provide indemnification to the purchaser. This is a reasonable guarantee against pre-existing debts or liabilities. In addition it should conduct reasonable due diligence prior to offering the shelf corporation for sale.

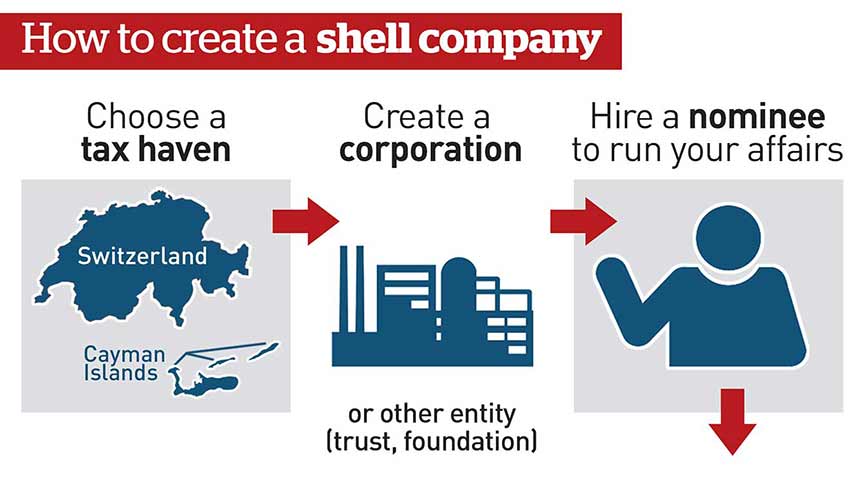

Shell Corporations

Often times Shelf or Aged Corporations are confused with Shell Corporations, both in terms of definition and their reason for existence. This confusion could not be more erroneous. Shell corporations are completely different entities, both in scope and in formation.

A shell corporation is an incorporated company that does not have any significant assets or operational structure. It may be a US entity or an International Business Corporation (IBC ). You may have a Personal Investment Company (PIC), front company or “mailbox” company. There are some legitimate reasons for the existence of shell corporations. For example, some professionals turn shell corporations into publicly traded companies. Professionals perform this process through the extensive filing and approvals by the appropriate governmental and regulatory agencies. These companies are often merged with existing businesses. We call this a what is called a reverse merger. This is one manner in which one can go public quickly and efficiently.

Shelf and Aged Corporation Advantages

- Saving time by foregoing the time and expense of forming a brand new corporation

- Instant access to contract bidding may not be possible in all cases. Most bidding contracts require that your company be in existence for a specified minimum length of time. Be sure to check on a case-by-case basis and use full disclosure as to when you acquired your company.

- Instant company acquisition.

- Corporate filing longevity.

- May be more attractive to potential investors and investment capital. Naturally on needs to make the proper legal filings. The age of the company, alone, is only a minor factor.

- May or may not have faster and easier access to borrowing. Again there are other factors that have more weight such as business credit rating and profitability.

Nonetheless, we recommend honesty and full disclosure as to the date that you acquired the aged company.

Disadvantages and Caveats

- Pre-existing liability potential

- Possible pre-existing debt issues

- Pre-existing business transactions that may lead to future liability

Conclusion

There are some tremendous benefits to using aged shelf corporations. The important thing is to purchase the entity through a reputable company that has a longstanding reputation. Our organization offers aged companies for sale. The founder of General Corporate Services, Inc., the company that manages the Companies Incorporated brand, originally established the company in 1906. Our current management has been in place since 1991. Feel free to call or fill out a free consultation form on this page.