The advantages of a Nevada LLC, or limited liability company, include asset protection from lawsuits, privacy of ownership, ease of formation and tax benefits. Some of the disadvantages are slightly higher filing and business license fees than other states, and the commerce tax for business with over $4 million of Nevada gross revenue.

There are many methods available for structuring your company, but one of the easiest and most affordable options out there is to form a limited liability company. Before you begin your journey toward business ownership, you need to decide in which state you would like to incorporate your LLC. While Delaware and Wyoming are popular options, Nevada offers a wide range of benefits, including strong privacy protection and a business-friendly environment. If you’re considering incorporating an LLC in Nevada, this guide can help you get started.

The Basics of Limited Liability Companies

Limited liability companies, or LLCs, have many of the benefits of a corporation without as many of the rules, regulations, and compliance issues. There are members, not shareholders. So there are no required shareholders meetings as there are with corporations. There are no directors with most LLCs, so there are no board of director’s meetings. So, annual formality requirements of an LLC are much less than with a corporation.

According to Investopedia, LLCs are hybrid entities that provide liability protection for owners, meaning that if your company goes under your personal assets are not at risk. LLCs are designed for startups and small- and medium-sized businesses because they allow for more flexibility, pairing corporate characteristics with those of a partnership or sole proprietorship to facilitate business ownership.

We call LLC, owners members. To organize an LLC, one or more members will typically contact an organization such as ours to file articles of organization with their state of choice. The articles of organization include basic information such as the company’s name and address and the name of the registered agent. In Nevada, one must simultaneously obtain a state business license. Most of the other company details are spelled out in an operating agreement. For example, they specify management and organizational preferences in the operating agreement.

Taxation

In addition, LLC owners can choose how the IRS will tax their company. For example, if one owner, the IRS treats it as a sole proprietorship for tax purposes. With two or more owners, the IRS taxes the LLC as a partnership. With additional filings, the IRS will treat the LLC as a C corporation or an S corporation for tax purposes.

Next, let’s discuss the pros and cons, the pluses and minuses of form an LLC Nevada. First, we will discuss the advantages.

Advantages of Forming an LLC in Nevada

When it comes to establishing your own business, creating a Nevada LLC may be the perfect solution. Not only will you have many of the protections provided to large corporations, but you will have the flexibility to run your business as you see fit. Take a look at some of the following Nevada LLC benefits to see if starting a limited liability company in the Silver State is right for you.

Strong privacy protection

One of the many privacy protections offered to owners (members) of a Nevada LLC is that their names do not become part of the public record. This allows them to stay private and anonymous. This level of privacy even permits a Nevada LLC to issue membership for capital, real estate, services, or personal property. The value of such a transaction is determined by the LLC directors and outlined in the articles of incorporation. Nevada considers these decisions final. Keep in mind, in order to issue membership for items of value, you will want to be sure to have a securities attorney properly guide you.

Personal liability protection

Another advantage of a Nevada LLC is that members are not personally liable for the debts of the business. This means creditors cannot readily take money or property from a member to pay off the business debts of the LLC. This does two good things. First, it protects LLC members from the company’s debts. Second, it limits exposure to any personal debts or liabilities of other LLC members. So, let’s suppose that someone files a lawsuit against the company or one of your co-owners racks up a ton of personal debt. That means that means that the lawsuit does not expose your personal assets like your car, house, or bank account.

Charging order protection

Actually, the only legal procedure available to creditors for going after an LLC member’s ownership interest is a charging order. A charging order directs the LLC to pay the creditor any distributions or profits that would have gone to the named member, partner, or owner. This doesn’t affect the LLC’s management, only the debtor’s financial rights. While a creditor may apply for and obtain a charging order, they can’t force an LLC to make a distribution. In addition, in Nevada they cannot make the court sell/dissolve/foreclose on the company to pay off the debt.

So, that is how the charging order protection works. The creditor can put a charging order on the member’s interest. However, the creditor cannot take the company or the property inside of the company.

The owner-debtor cannot directly take distributions out of the company until the settlement is paid. There are ways around this, however. What if the Nevada LLC buys items and the member uses them? Examples may include business vehicles, computers, real estate, and others.

Now, the next one is big. Real big. Unlike most states, Nevada offers protection against charging orders for both single-member LLCs and multi-member LLCs. The single-member LLC charging order protection makes it one of the friendliest states for those who wish to form an LLC.

Easy to form, organize, and maintain

Forming a Nevada LLC is a relatively quick and easy process. Call and let us know your desired company name and an alternative. We will need the name and shipping address of the first company manager. Filing with the state takes a few days with the expedited service.

How to organize your Nevada LLC is up to you. You can call your own shots by forming a single-person LLC or take on an unlimited number of owners and investors. None of them have to live or work in the state. For multi-person LLCs, it’s recommended that you have an operating agreement. This is a document LLC members sign that sets the ground rules for the company. The operating agreement spells out all management and organizational preferences and establishes an income distribution policy.

Nevada LLCs also have several perks when it comes to maintenance. For example, Nevada LLCs can have annual meetings, if you desire. You can hold them in person or via teleconference – anywhere in the world. Other perks of maintaining a Nevada LLC include the following:

- No formal information-sharing with the IRS

- No required list of company assets as long as the company remains in good standing

- LLC members can appoint nominee officers to act as stand-ins for the publicly recorded LLC manager.

Tax benefits

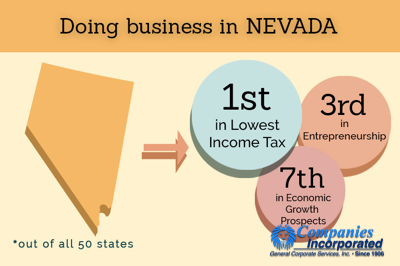

Nevada stands out from the crowd in terms of taxes because the state doesn’t have an income tax department. In other words, you don’t have to worry about Nevada state taxes on corporate profits or shares, stock transfers, or LLC ownership. Additionally, the state has no franchise, personal income, inventory, business and occupation, or gift tax, and payroll taxes are equal to 0.7 percent of gross wages. As stated above, Nevada also does not provide information to the IRS.

Now, if you are responsible for federal income taxes. In addition, you may need to pay taxes to your home state on the income of your Nevada LLC.

When forming a Nevada LLC, members have the choice of how they want to be taxed. Options include:

- Sole proprietorship (single-member LLCs)

- Partnership (multi-member LLCs)

- S Corporation

- C Corporation

Unless you choose taxation as a C corporation, LLC profits are passed through to members. Thus, such members then pay federal income and self-employment tax on their share of the profits.

Nevada LLC Disadvantages

Fees

Better things usually cost more. It is no different with the Nevada LLC. The Nevada legislature has carefully crafted its laws to surpass other jurisdictions. They do this to attract investment in the state and to collect more company filing fees. Thus, they charge more than many other states. In Nevada you must obtain a business license. As of this writing the business license is $200 for an LLC and $500 for a corporation. There is also an initial list of LLC managers that costs $150.

The initial filing fee varies from time to time but is fairly reasonable. Done professionally, will also need to cover the cost of company formation and pay the registered agent fee. So, the fees are affordable for most people but they are more than some other states. As the saying goes, you get what you pay for.

Use in other states

Many people set up Nevada LLCs and then register them to do business in their home states. As such the operating agreement can require some items to be litigated in Nevada courts. Nevada tends to be very business friendly. Thus, this arrangement can be beneficial such that interpretation of the operating agreement and inner-company disputes are litigated in Nevada.

It is usually another story when the business incurs liability within the state of operation. Suppose someone slips and falls on a piece of California real estate that a Nevada LLC owns. The courts will hear such a case in California, not Nevada.

So, there are some benefits to operating a Nevada corporation in another state. But for some disputes it will not make much of a difference whether you operate out of a Nevada LLC or an LLC in your home state.

Commerce tax

There is no income tax, per se, on corporations. On July 1, 2015, Nevada imposed a tax on all business that have $4 million or more in gross revenue. This is for Nevada-based revenue. So, if your Nevada gross revenues exceed $4 million, your LLC may need to pay the Commerce Tax. Again, this is revenue you actually produce in the state of Nevada.

The Commerce Tax rates as of this writing are less than one -percent at 0.051% to 0.331%. There are also some taxes that apply to specific industries such as the gaming industry. There are no deductions for this tax. It applies to gross receipts, regardless of expenses, not net. If you have, for example, 10 Nevada LLCs, the state will look at majority ownership. So, if each has $4 million in revenue, they will tax the $36 million above the $4 million limit.

Nevada LLCs vs Delaware LLCs

People have often looked to Delaware to incorporate their LLC due to its developed legal system and laws protecting shareholder rights. However, Nevada – also an incorporation-friendly state. Nevada may be a more attractive option for small privately-owned businesses and LLCs. For one thing, you do not have to designate a separate manager in order to form your Nevada LLC. Also, Nevada is the only state that doesn’t collect corporate income tax information to share with the IRS. Unlike Delaware, Nevada has no franchise tax, no state personal income tax, and no tax on corporate shares. Furthermore, Nevada offers the best corporate veil protection for agents, employees, officers, and directors. This separates the owners’ assets and liabilities from that of the company and protects them from business risk.

How to Form a Nevada LLC

Oftentimes, simply deciding if, when, and where to start your own business is the hardest part. But once you’ve chosen to incorporate your LLC in Nevada, it’s all downhill from here. In other words, forming a Nevada LLC is relatively straightforward and the filing process takes about 4-6 weeks. Expedited options are available for a fee.

So, let’s jump right into the formation process. Here is what to do now:

Naming your LLC

One of the first things you need to do in the Nevada LLC formation process is to choose a name. Under Nevada law, your company name must follow the rules and regulations set forth by the Nevada Secretary of State. These rules include:

- The company name must include the words “Limited Liability Company” or one of its abbreviations.

- The name must be distinguishable from other companies already on file. Please check the availability of your company name on Nevada’s business name database.

- The name should not include restricted words, such as “bank” or “trust” without requisite approval. Please check Nevada’s Restricted Word List.

We can file a Name Reservation Request online to reserve your chosen name for 90 days if you like.

Appointing a registered agent

Nevada state law requires every LLC to have a registered agent. This individual or business entity will act as your company’s main point of contact within the state and agree to receive all legal documents on your behalf. They must reside and do business in Nevada and have a physical street address in the state. We provide registered agent service in Nevada as well as all other states.

Filing the Articles of Organization

The next step in the Nevada LLC formation process is to file your Articles of. We will include the following information in the articles.

- Name and address of the company

- Name, address, and signature of the registered agent(s)

- Whether the LLC is run by managers or members

- Name and address of each manager or managing member

- Name, address, and signature of each organizer executing the Articles of Organization

- Signature of the Registered Agent

- Initial List of Managers or Managing Members

- State business license

Preparing an operating agreement

While an operating agreement is not required for a Nevada LLC, it is strongly recommended, especially for multi-member companies. This legal document outlines the company’s ownership and operating procedures. It guards your limited liability status, prevents financial and management misunderstanding. In addition, the operating agreement helps to that members and managers govern your company according to your rules.

Acquiring an EIN

Obtaining an Employer Identification Number (EIN) from the IRS is a crucial step in the LLC formation process. Even if your company has no employees, you need an EIN to open a bank account. An EIN identifies your business for tax and filing purposes and allows you to open a company bank account, apply for licenses and permits, and handle employee payroll, if applicable. We can obtain your EIN for you if you wish.

Still Have Questions?

Establishing your own company can be an exciting experience. But navigating the process may seem confusing if you don’t have the right guide. Our Nevada LLC experts are happy to help you navigate the LLC formation process and answer any questions you may have. We’re here to ensure that you have all of the information you need to succeed. So, give us a call today, order online, or fill out an consultation form to get started.